One Unified Platform, Purpose-Built for Financial Services

With a secure, modular architecture, OnePoint enables institutions to evolve at their own pace — simplifying legacy modernization, enabling Open Banking, and powering the shift to Open Finance.

Unlocking Financial Innovation: The OnePoint 3-Stage Framework

Foundation:

Core Modernization

API Gateway & Lifecycle Management

Connectors & System Integration

Observability & Monitoring

Expansion:

Open Banking Readiness

Compliance & Policy Engine

Developer Portal & TPP Access

Identity & Consent Management

Elevation:

Open Finance Enablement

Secure Data Exchange Layer

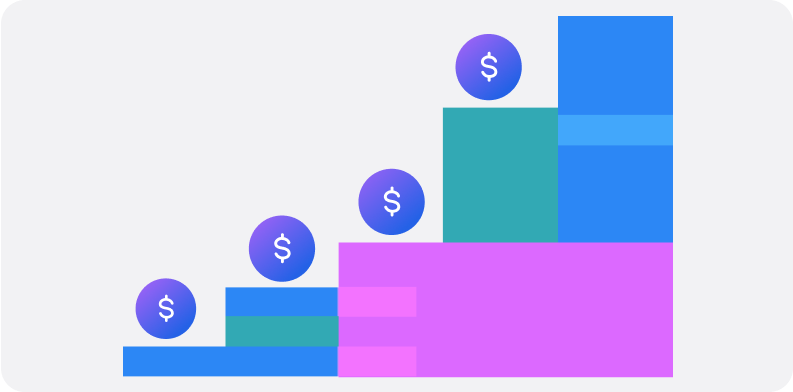

Driving outcomes that matter

40%

Faster Integration

Reduced time-to-deploy using our pre-built connectors and legacy modernization approach.

99.9%

Uptime Reliability

30%

Growth in API Transactions

5x

Boost in Developer Productivity

OnePoint’s trusted capabilities

Engineered for scalability, compliance, and intelligent finance.

Composable, Scalable Architecture

Microservices-first and cloud-native, built for modular deployments and rapid extensibility.

DevOps-Aligned Infrastructure

CI/CD ready, containerized, and cloud-agnostic for agile release and environment control.

Observability and Control

End-to-end visibility with real-time metrics, traces, alerts, and policy-driven governance.

AI-Ready Data Foundation

Consent-based data flow, API logging, and standard-aligned models to power AI initiatives.

Expand your capabilities and impact

OnePoint helps you do more than just connect enabling growth, innovation, and monetization.

Ecosystem Partnerships

Collaborate with fintechs, vendors, and other partners to create richer, more innovative ecosystems.

Monetization Opportunities

Offer your APIs and datasets to generate new, recurring revenue streams securely.

OnePoint helps you unlock your industry’s potential

OnePoint meets the needs of every player in the financial sector helping you stay ahead of change.

Banks & Financial Institutions

Fintechs & Third-Party Providers

Connect securely to partner banks through APIs and bring your products like wallets, lending apps, PFM tools, and insurtech to customers quickly and reliably.

Regulators

Ensure compliance, enforce policy, and oversee secure, transparent data sharing across your regulated ecosystem all with ease and control.

Frequently asked questions

What is OnePoint Financial Services?

OnePoint is a technology provider designed to help financial institutions modernize core systems, enable open banking, and transition to open finance—all while leveraging existing infrastructure.

What services does OnePoint offer?

- Foundation / Core Modernization: Update legacy systems without full replacement via middleware, secure API gateways, connectors, and observability tools.

- Expansion / Open Banking Readiness: Enables banks to open APIs securely, supporting sandbox environments, TPP onboarding, and compliance with standards like OBIE, FAPI, OpenAPI, and ISO 20022.

- Elevation / Open Finance Enablement: Facilitates consent-based data sharing with third parties using frameworks like ReBIT AA and Estonia’s X‑Road, aiming to help banks monetize data and support innovation.

Can OnePoint integrate with existing or legacy banking systems?

Absolutely—OnePoint offers adaptable connectors and middleware that plug into both legacy cores and modern stacks, simplifying integration.

What compliance standards does the platform support?

OnePoint supports compliance for industry standards such as OBIE, FAPI, OpenAPI specifications, and ISO 20022 in open banking contexts.

How does OnePoint help us innovate faster?

The platform empowers banks to launch digital products within weeks (not months), removes vendor lock‑in, strengthens partnerships with fintechs and wallets, and enables revenue generation via secure API sharing.

What are the platform’s performance and reliability features?

OnePoint is internationally trusted and locally recognized:

- Featured in a Gartner listing (platform unspecified)

- Winner of the Product ICT Award and the National ICT Innovation Award in Nepal.

Can I see real client success stories?

Yes! Customer testimonials include:

- Citizens Bank: Simplified middleware and strengthened API infrastructure

- Global IME Bank: Partnered to drive digital transformation in Nepal.

- NMB Bank, Kumari Bank, Siddhartha Bank: Highlighting effectiveness in API orchestration, core innovation, and strategic agility.

Does OnePoint offer trial access or sandbox environments?

Yes—part of the open banking stage includes sandbox environments and tools for onboarding Third-Party Providers (TPPs).

How can I get started or request a demo?

You can request a demo or contact the team directly via the "Request a Demo" or "Contact Us" links on their site.

Ready to modernize your financial journey?

We’re here to help you transform securely, at your pace.